Where Is The 199A Deduction Taken On Form 1040

Where Is The 199A Deduction Taken On Form 1040 - Where is the § 199a deduction taken on form 1040? Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. It is a business deduction and is.

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Understanding the § 199a deduction ###. Where is the § 199a deduction taken on form 1040? It is a business deduction and is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. This deduction propagates from the qbi deduction summary to the 1040 worksheet. Where is the § 199a deduction taken on form 1040? Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is.

Qualified Business Deduction Worksheet

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. It is a business deduction and is. Where is the § 199a deduction taken on form 1040? Understanding the § 199a deduction ###.

The Accidental CFO The Section 199A Deduction by Chris and Trish Meyer

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Where is the § 199a deduction taken on form 1040? Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is.

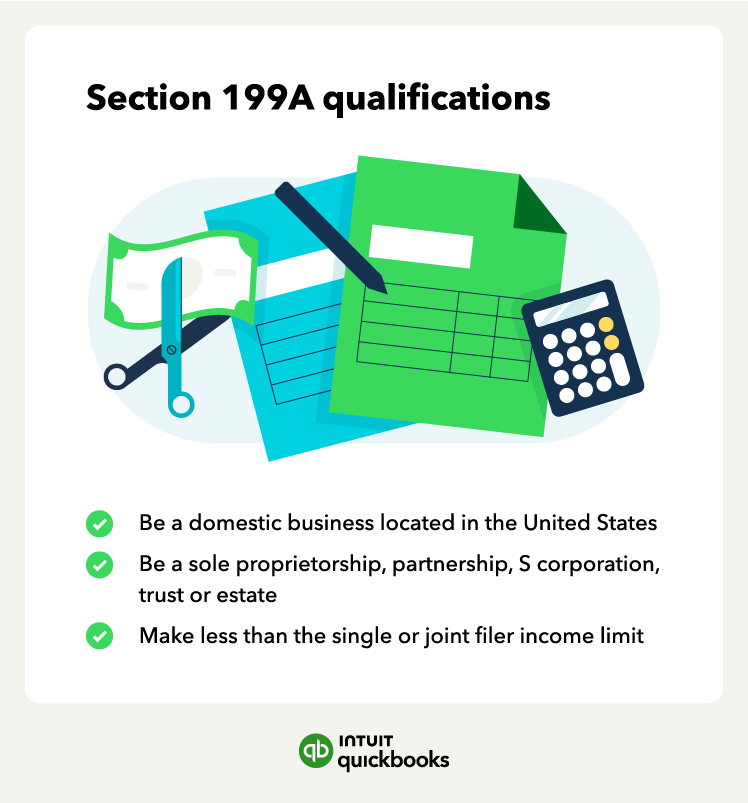

Section 199A deduction explained for 2023 QuickBooks

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Where is the § 199a deduction taken on form 1040? It is a business deduction and is.

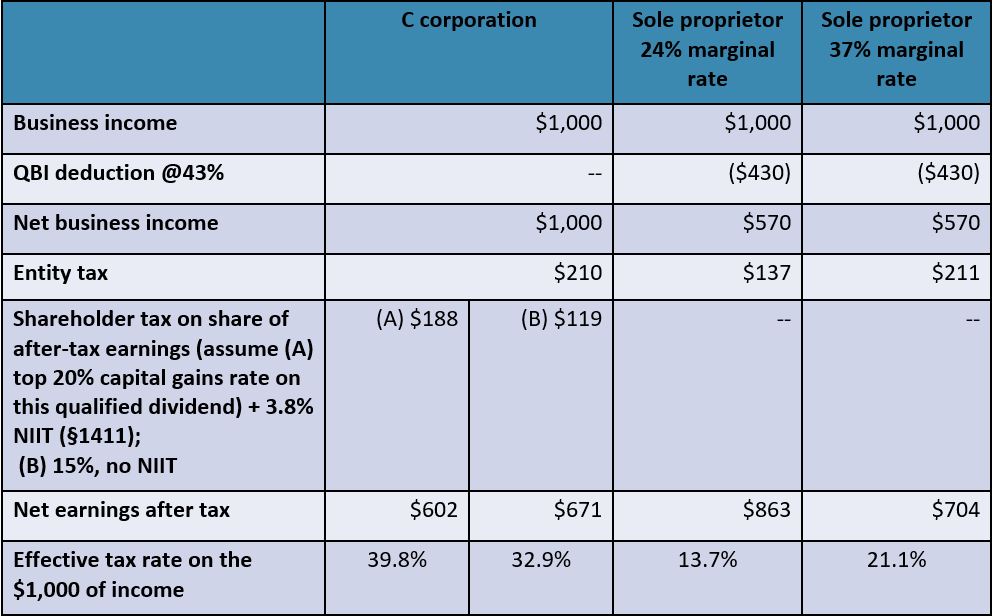

Analysis of a Section 199A Qualified Business Deduction Proposal

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Understanding the § 199a deduction ###. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is.

Section 199A Qualified Business Deduction WCG CPAs

Understanding the § 199a deduction ###. This deduction propagates from the qbi deduction summary to the 1040 worksheet. It is a business deduction and is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates.

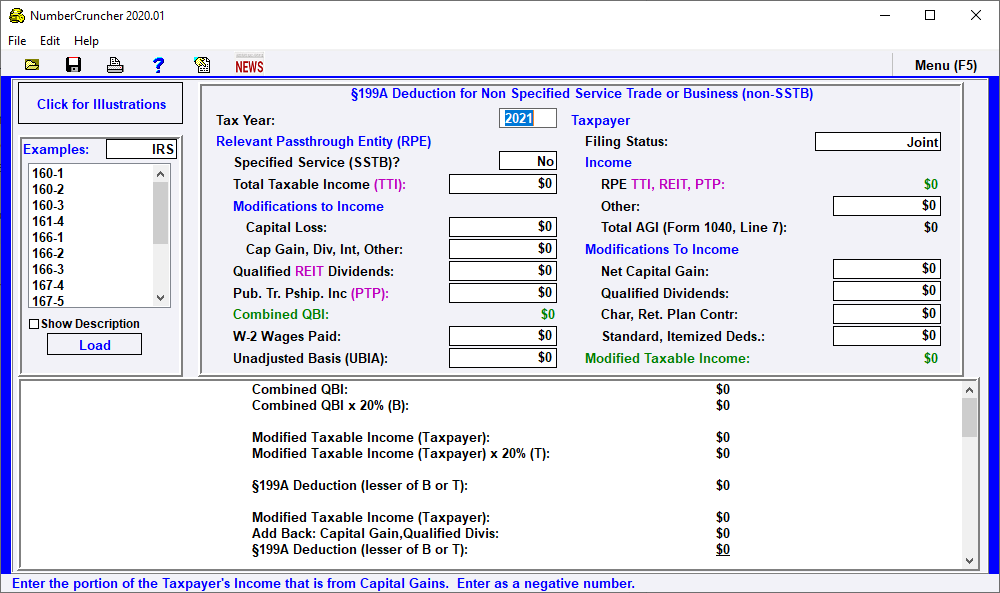

General §199A General Deduction Leimberg, LeClair, & Lackner, Inc.

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Understanding the § 199a deduction ###. It is a business deduction and is.

Section 199A Deduction 2023 2024

This deduction propagates from the qbi deduction summary to the 1040 worksheet. Understanding the § 199a deduction ###. Where is the § 199a deduction taken on form 1040? Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. It is a business deduction and is.

Understanding 199A Deduction (Updated for 2022)

Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates. Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet.

Capture Your 199A Tax Deduction

It is a business deduction and is. Where is the § 199a deduction taken on form 1040? Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Understanding the § 199a deduction ###. This deduction propagates from the qbi deduction summary to the 1040 worksheet.

Section 199a Deduction Worksheet Master of Documents

Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Where is the § 199a deduction taken on form 1040? It is a business deduction and is. This deduction propagates from the qbi deduction summary to the 1040 worksheet.

This Deduction Propagates From The Qbi Deduction Summary To The 1040 Worksheet.

Understanding the § 199a deduction ###. Between 2018 and 2025, irc section 199a allows individuals, trusts, and estates. Where is the § 199a deduction taken on form 1040? Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates.