What Happens When You File Fincen Form 105

What Happens When You File Fincen Form 105 - Furthermore, if you receive in the united states, currency or other monetary instruments in an. Customs, you’ll need to file a fincen form. When you declare over $10,000 at u.s. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Report of international transportation of currency or monetary instruments this form is available.

Furthermore, if you receive in the united states, currency or other monetary instruments in an. Customs, you’ll need to file a fincen form. When you declare over $10,000 at u.s. Report of international transportation of currency or monetary instruments this form is available. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper.

Furthermore, if you receive in the united states, currency or other monetary instruments in an. When you declare over $10,000 at u.s. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Report of international transportation of currency or monetary instruments this form is available. Customs, you’ll need to file a fincen form.

FinCEN Form 105 Airport Seizures of Cash for Money Laundering

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. When you declare over $10,000 at u.s. Furthermore, if you receive in the united states, currency or other monetary instruments in an. Report of international transportation of currency or monetary instruments this form is available. Customs, you’ll need to file a fincen form.

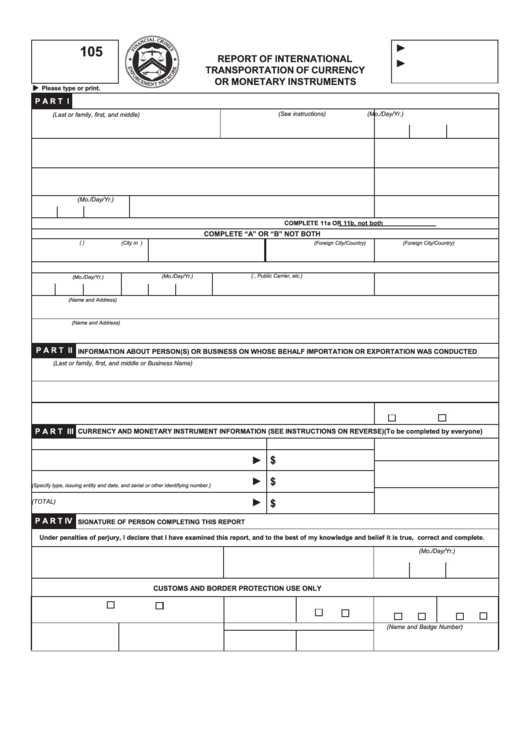

U.S. TREAS Form treasirsfincen1052003

Furthermore, if you receive in the united states, currency or other monetary instruments in an. Customs, you’ll need to file a fincen form. When you declare over $10,000 at u.s. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Report of international transportation of currency or monetary instruments this form is available.

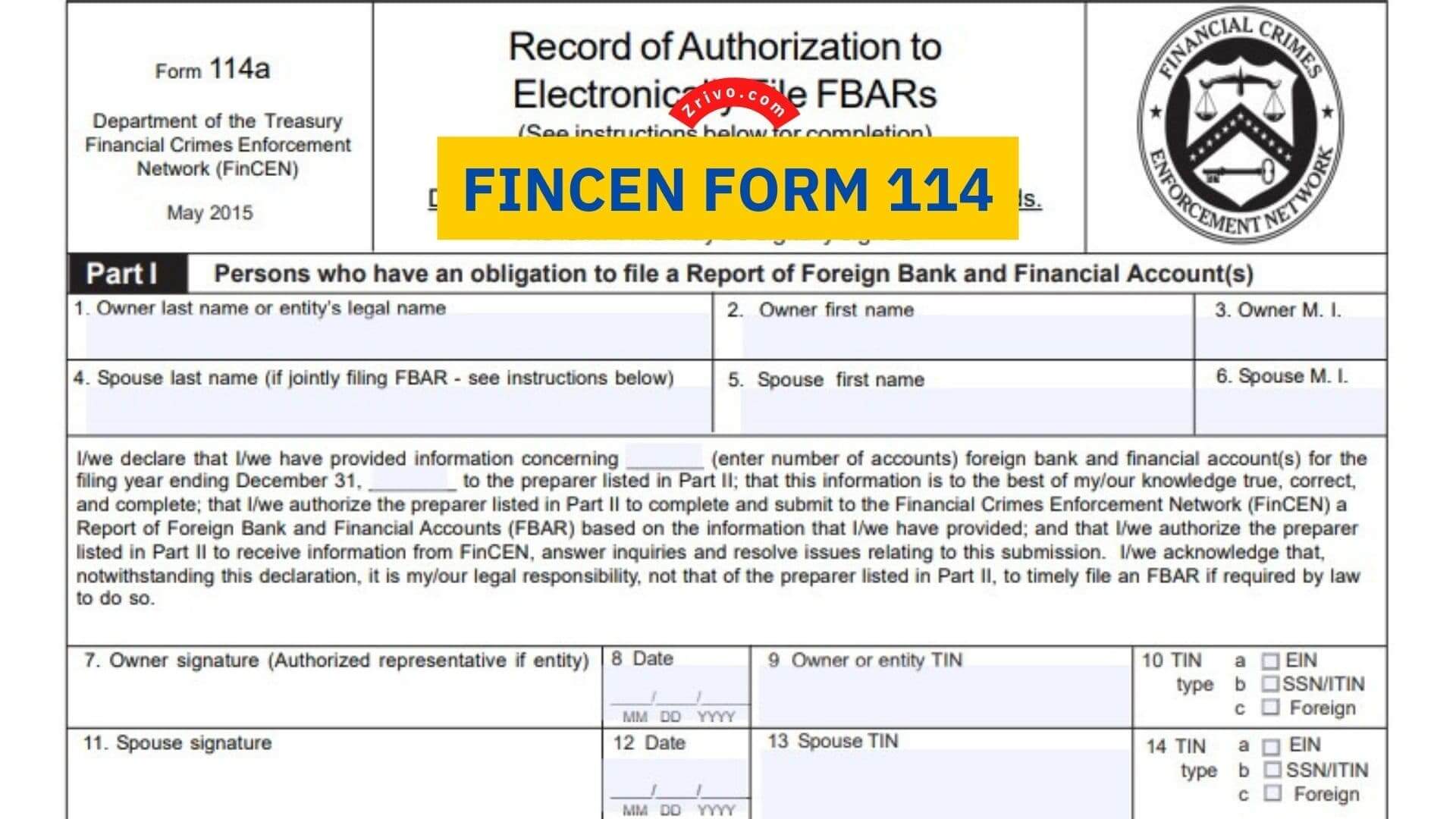

Fillable Online FinCEN Form 114 Everything You Need to Know to File

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. When you declare over $10,000 at u.s. Furthermore, if you receive in the united states, currency or other monetary instruments in an. Customs, you’ll need to file a fincen form. Report of international transportation of currency or monetary instruments this form is available.

Printable Fincen Form 105 Printable Forms Free Online

Furthermore, if you receive in the united states, currency or other monetary instruments in an. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Customs, you’ll need to file a fincen form. Report of international transportation of currency or monetary instruments this form is available. When you declare over $10,000 at u.s.

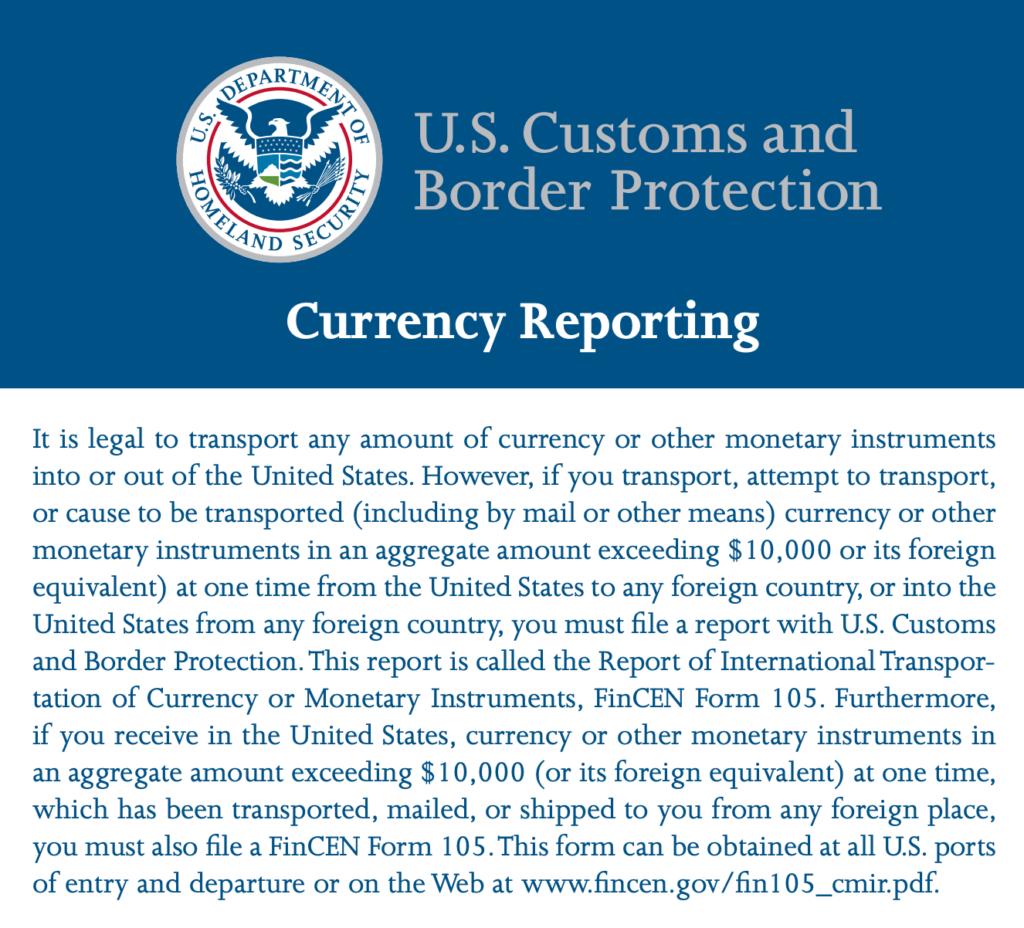

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

When you declare over $10,000 at u.s. Furthermore, if you receive in the united states, currency or other monetary instruments in an. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Report of international transportation of currency or monetary instruments this form is available. Customs, you’ll need to file a fincen form.

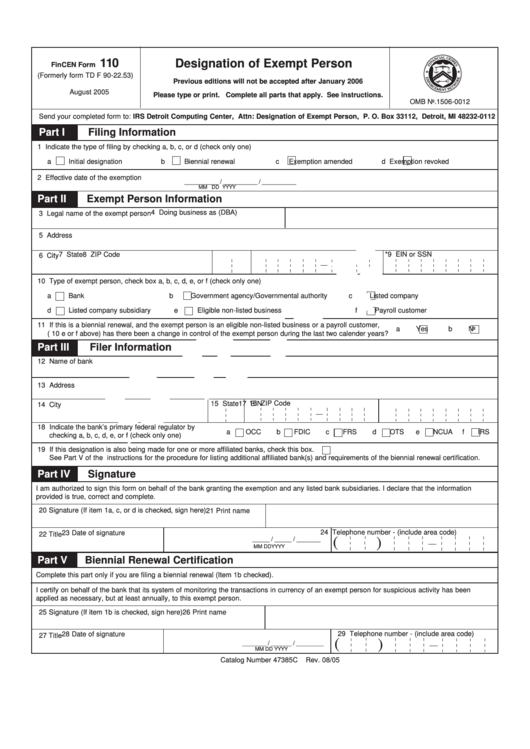

Fillable Fincen Form 110 Designation Of Exempt Person printable pdf

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Furthermore, if you receive in the united states, currency or other monetary instruments in an. When you declare over $10,000 at u.s. Customs, you’ll need to file a fincen form. Report of international transportation of currency or monetary instruments this form is available.

Printable Fincen Form 105 Printable Forms Free Online

When you declare over $10,000 at u.s. Furthermore, if you receive in the united states, currency or other monetary instruments in an. Report of international transportation of currency or monetary instruments this form is available. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Customs, you’ll need to file a fincen form.

What is the FinCEN Form 114? (Guidelines) Expat US Tax

Report of international transportation of currency or monetary instruments this form is available. When you declare over $10,000 at u.s. Customs, you’ll need to file a fincen form. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Furthermore, if you receive in the united states, currency or other monetary instruments in an.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Report of international transportation of currency or monetary instruments this form is available. Furthermore, if you receive in the united states, currency or other monetary instruments in an. When you declare over $10,000 at u.s. Customs, you’ll need to file a fincen form. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper.

FinCEN Form 114 2024 2025

Furthermore, if you receive in the united states, currency or other monetary instruments in an. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper. Report of international transportation of currency or monetary instruments this form is available. Customs, you’ll need to file a fincen form. When you declare over $10,000 at u.s.

Use The Online Fincen 105 Currency Reporting Site Or Ask A Cbp Officer For The Paper.

Furthermore, if you receive in the united states, currency or other monetary instruments in an. Report of international transportation of currency or monetary instruments this form is available. Customs, you’ll need to file a fincen form. When you declare over $10,000 at u.s.