Tax Form 8233

Tax Form 8233 - Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.

Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

16 Form 8233 Templates free to download in PDF

Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

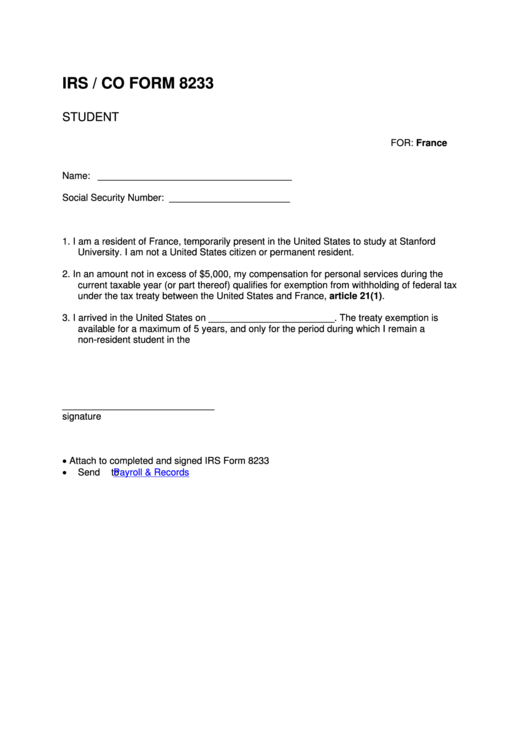

Irs / Co Form 8233 printable pdf download

Nonresident alien students, trainees, professors/teachers, and researchers using. Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or.

Top 17 Form 8233 Templates free to download in PDF format

A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using.

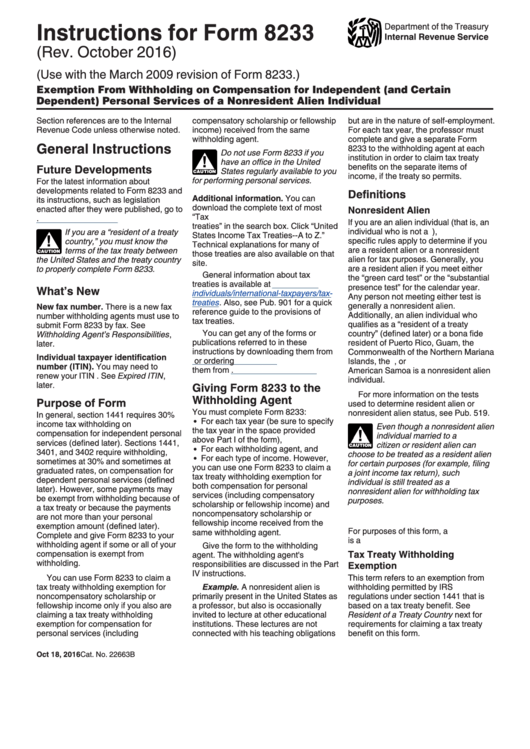

Instructions For Form 8233 2016 printable pdf download

Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.

Fill Free fillable Form 8233 Exemption From Withholding on

Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from.

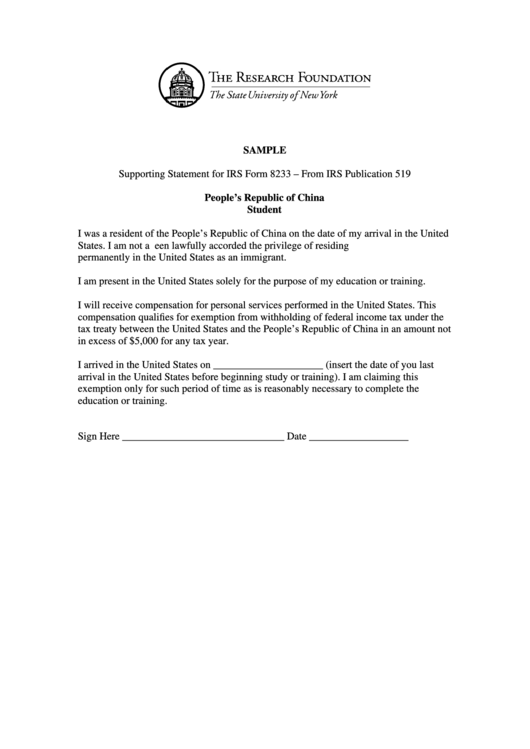

8233 Printable PDF Sample

A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using.

Understand Form 8233 for NonResident Alien Tax Exemptions Trolley

Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using. A tax treaty withholding exemption (independent personal services, business profits) for part or.

IRS 8233 2001 Fill out Tax Template Online US Legal Forms

A tax treaty withholding exemption (independent personal services, business profits) for part or. Form 8233 is used by nonresident alien individuals to claim exemption from. Nonresident alien students, trainees, professors/teachers, and researchers using.

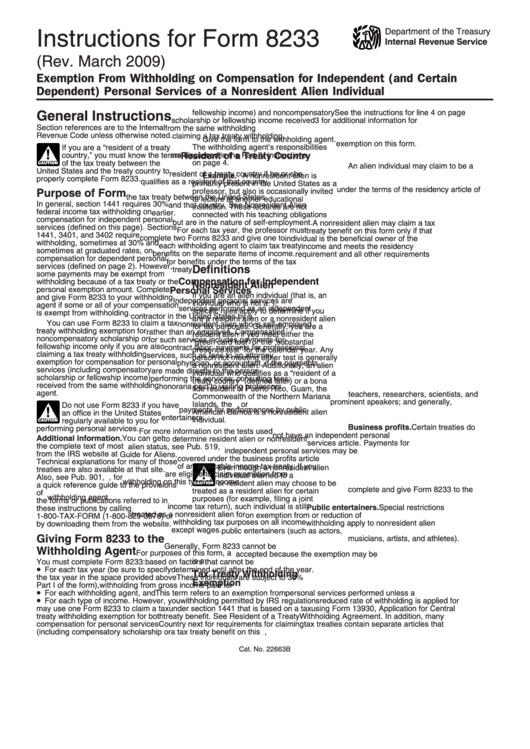

Download Instructions for IRS Form 8233 Exemption From Withholding on

Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.

List of Form 8233 Tax Treaty Countries With Calculator Internal

Form 8233 is used by nonresident alien individuals to claim exemption from. A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.

Form 8233 Is Used By Nonresident Alien Individuals To Claim Exemption From.

A tax treaty withholding exemption (independent personal services, business profits) for part or. Nonresident alien students, trainees, professors/teachers, and researchers using.