Disclosure Of Fixed Deposit In Balance Sheet

Disclosure Of Fixed Deposit In Balance Sheet - Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Let us learn about the disclosure of assets and liabilities as per schedule vi. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Share capital is disclosed in the following form:. Disclosure of fixed asset deposits. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016.

The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Disclosure of fixed asset deposits. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Share capital is disclosed in the following form:. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Let us learn about the disclosure of assets and liabilities as per schedule vi. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures.

Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. The disclosure of deposits on fixed assets in financial statements is a transparent way to. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Let us learn about the disclosure of assets and liabilities as per schedule vi. Share capital is disclosed in the following form:. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Disclosure of fixed asset deposits.

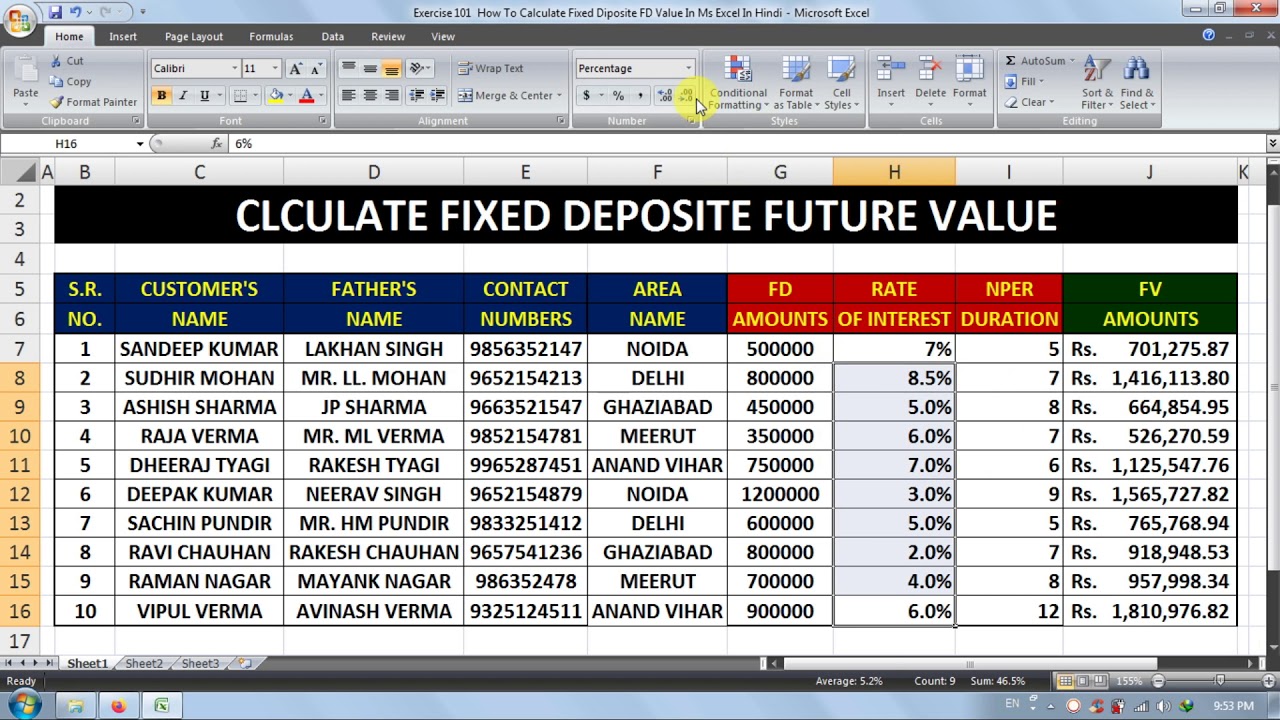

Fixed Deposit Excel Sheet Template Free Download Printable Calendars

Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Disclosure of fixed asset deposits. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance.

Silicon Valley Bank's balance sheet Why customer deposit withdrawals

Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Share capital is disclosed in the following form:. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposits with maturity upto 12 months from date of balance sheet and.

Fixed Deposit Excel Sheet Template Free Download

It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Share capital is disclosed in the following form:. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown.

Best Time Deposit Classification In Balance Sheet Consolidated Accounts

Share capital is disclosed in the following form:. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown.

Fixed Deposit Product Disclosure English PDF Interest Interest Rates

The disclosure of deposits on fixed assets in financial statements is a transparent way to. Disclosure of fixed asset deposits. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the.

Financial Statement Bank Deposit Cash Balance Sheet Excel Template And

Let us learn about the disclosure of assets and liabilities as per schedule vi. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Learn how to report fixed.

Fabulous Certificate Of Deposit On Balance Sheet Unaudited Profit And

The disclosure of deposits on fixed assets in financial statements is a transparent way to. Let us learn about the disclosure of assets and liabilities as per schedule vi. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown.

Us Gaap Balance Sheet Format Deferred Tax Disclosure Example Balance

Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Let us learn about the disclosure of assets and liabilities as per schedule vi. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the.

[Solved] The balance sheet and disclosure of signi SolutionInn

Disclosure of fixed asset deposits. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is.

Fillable Online FixedDepositProductDisclosureSheet Baiduri

Share capital is disclosed in the following form:. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Let us learn about the disclosure of assets and liabilities as per schedule vi. Tds receivable is.

It Sets Out The Minimum Requirements For Disclosure On The Face Of The Financial Statements, I.e., Balance Sheet,.

The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Let us learn about the disclosure of assets and liabilities as per schedule vi.

Disclosure Of Fixed Asset Deposits.

Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Share capital is disclosed in the following form:. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

![[Solved] The balance sheet and disclosure of signi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images14/1265-B-C-A-C-B-A-M(2303).png)