Convert Rental Property To Primary Residence

Convert Rental Property To Primary Residence - The rental property had a $30,000. On january 1, 2011, she evicts her. 1, 2022, the taxpayers convert the rental property into their principal residence. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations.

1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. On january 1, 2011, she evicts her.

1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations.

How to Convert a Primary Residence to a Rental Property

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property.

How to Convert Your Primary Residence to a Rental Property

The rental property had a $30,000. On january 1, 2011, she evicts her. 1, 2022, the taxpayers convert the rental property into their principal residence. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal,.

How to Convert a Property from Rental to Primary

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property.

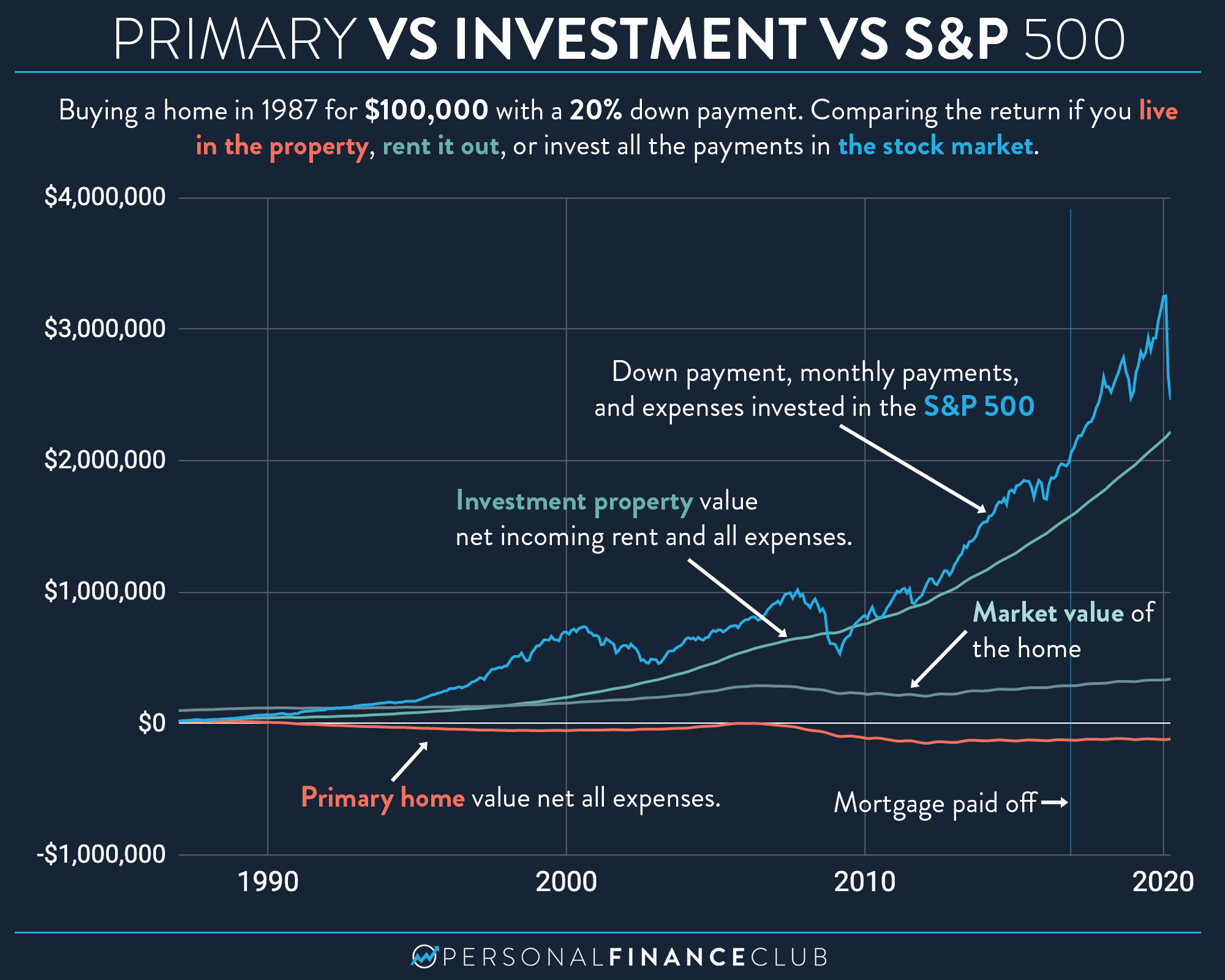

Primary home vs investment property vs S&P 500 Personal Finance Club

1, 2022, the taxpayers convert the rental property into their principal residence. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. On january 1, 2011, she evicts her. The rental property.

How To Convert A Primary Residence To A Rental Property Landlord Studio

Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. On january 1, 2011,.

How to Convert a Primary Residence to a Rental Property

The rental property had a $30,000. On january 1, 2011, she evicts her. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. 1, 2022, the taxpayers convert the rental property into their principal residence. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property.

How to Convert a Primary Residence to a Rental Property

The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal,.

How To Convert Your Primary Residence To A Rental Property Rental

Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. 1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. The rental property.

How To Convert A Primary Residence To A Rental Property Landlord Studio

1, 2022, the taxpayers convert the rental property into their principal residence. On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. The rental property.

How To Convert Your Primary Residence To A Rental Property Rental

1, 2022, the taxpayers convert the rental property into their principal residence. The rental property had a $30,000. Converting a rental or vacation home into your primary residence involves a mix of practical, legal, and financial considerations. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. On january 1, 2011,.

Converting A Rental Or Vacation Home Into Your Primary Residence Involves A Mix Of Practical, Legal, And Financial Considerations.

On january 1, 2011, she evicts her. Jane buys a home on january 1, 2009 for $400,000, and uses it as rental property for two years. The rental property had a $30,000. 1, 2022, the taxpayers convert the rental property into their principal residence.