95757 Local Sales Tax Rate

95757 Local Sales Tax Rate - When purchases are made locally and sales tax is. Click for sales tax rates, 95757 sales tax. Click for sales tax rates, elk grove sales. The tax rate within city limits is 8.75%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The current sales tax rate in elk grove, ca is 7.75%. This is the total of. The combined rate used in this. The minimum combined 2025 sales tax rate for 95757, california is 8.75%. For a list of your current and historical rates, go to the california city & county sales & use tax.

The current sales tax rate in 95757, ca is 8.75%. This is the total of. The current total local sales tax rate in elk grove, ca is 7.750%. When purchases are made locally and sales tax is. For a list of your current and historical rates, go to the california city & county sales & use tax. The combined rate used in this. Click for sales tax rates, elk grove sales. The tax rate within city limits is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%. The minimum combined 2025 sales tax rate for 95757, california is 8.75%.

The current sales tax rate in 95757, ca is 8.75%. The current sales tax rate in elk grove, ca is 7.75%. The current total local sales tax rate in elk grove, ca is 7.750%. Click for sales tax rates, 95757 sales tax. For a list of your current and historical rates, go to the california city & county sales & use tax. This is the total of. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: When purchases are made locally and sales tax is. Click for sales tax rates, elk grove sales. The tax rate within city limits is 8.75%.

Combined State and Average Local Sales Tax Rates Tax Foundation

The minimum combined 2025 sales tax rate for 95757, california is 8.75%. The tax rate within city limits is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%. The current total local sales tax rate in elk grove, ca is 7.750%. When purchases are made locally and sales tax is.

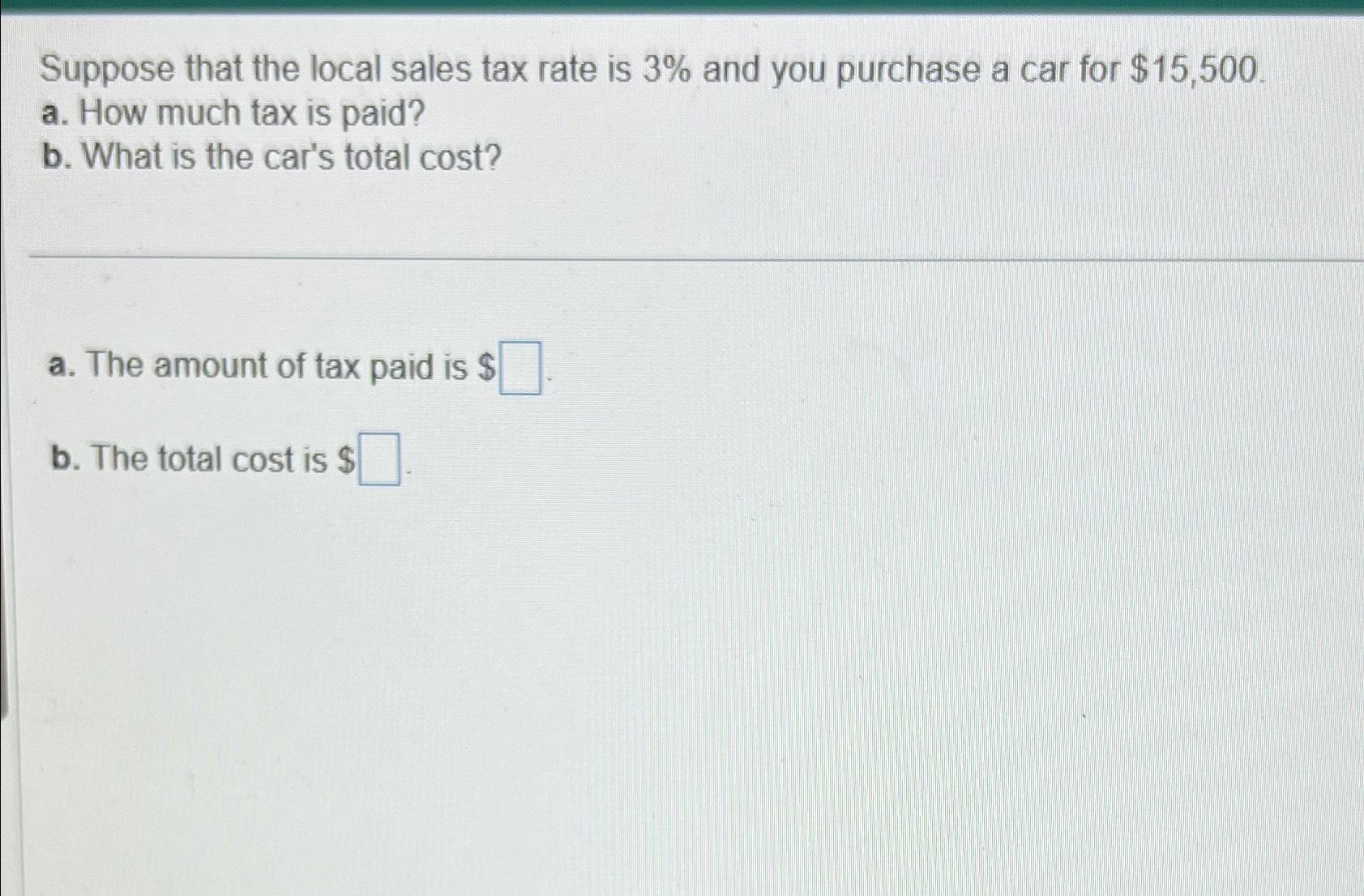

Solved Suppose that the local sales tax rate is 3 and you

This is the total of. The combined rate used in this. The current sales tax rate in elk grove, ca is 7.75%. For a list of your current and historical rates, go to the california city & county sales & use tax. The minimum combined 2025 sales tax rate for 95757, california is 8.75%.

Volusia County Sales Tax Rate 2024 Nani Tamara

For a list of your current and historical rates, go to the california city & county sales & use tax. Click for sales tax rates, 95757 sales tax. The current total local sales tax rate in elk grove, ca is 7.750%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The minimum combined.

State and Local Sales Tax Rates, Midyear 2020 Tax Foundation

The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The tax rate within city limits is 8.75%. When purchases are made locally and sales tax is. The current sales tax rate in elk grove, ca is 7.75%. The current total local sales tax rate in elk grove, ca is 7.750%.

Pasco County Sales Tax Rate 2024 Felice Kirbie

The combined rate used in this. The current sales tax rate in 95757, ca is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%. The current total local sales tax rate in elk grove, ca is 7.750%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes:

Washington's combined statelocal sales tax rate ranks 5th in the

The tax rate within city limits is 8.75%. The current sales tax rate in 95757, ca is 8.75%. The current total local sales tax rate in elk grove, ca is 7.750%. Click for sales tax rates, elk grove sales. This is the total of.

Louisiana has nation’s highest combined state and local sales tax rate

Click for sales tax rates, 95757 sales tax. Click for sales tax rates, elk grove sales. The current sales tax rate in 95757, ca is 8.75%. For a list of your current and historical rates, go to the california city & county sales & use tax. When purchases are made locally and sales tax is.

Washoe County Sales Tax Rate 2024 Cori Joeann

The current sales tax rate in 95757, ca is 8.75%. When purchases are made locally and sales tax is. For a list of your current and historical rates, go to the california city & county sales & use tax. The current sales tax rate in elk grove, ca is 7.75%. The 95757, elk grove, california, general sales tax rate is.

Washoe County Sales Tax Rate 2024 Cori Joeann

The 95757, elk grove, california, general sales tax rate is 8.75%. Click for sales tax rates, elk grove sales. When purchases are made locally and sales tax is. The minimum combined 2025 sales tax rate for 95757, california is 8.75%. For a list of your current and historical rates, go to the california city & county sales & use tax.

Colorado Sales Tax Rate 2025 Eilis Harlene

When purchases are made locally and sales tax is. The tax rate within city limits is 8.75%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The current sales tax rate in elk grove, ca is 7.75%. The 95757, elk grove, california, general sales tax rate is 8.75%.

Click For Sales Tax Rates, Elk Grove Sales.

Click for sales tax rates, 95757 sales tax. The current sales tax rate in elk grove, ca is 7.75%. For a list of your current and historical rates, go to the california city & county sales & use tax. The current sales tax rate in 95757, ca is 8.75%.

The Minimum Combined 2025 Sales Tax Rate For 95757, California Is 8.75%.

The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The current total local sales tax rate in elk grove, ca is 7.750%. The tax rate within city limits is 8.75%. This is the total of.

The Combined Rate Used In This.

The 95757, elk grove, california, general sales tax rate is 8.75%. When purchases are made locally and sales tax is.

.png)